My and my partner were sat together one evening, begrudgingly listening to the news and how everything from sultanas to energy and gas seems to be rising beyond control. It was mentioned how Bank of England (BoE) will be increasing interest rates to combat inflation. My partner was a bit taken aback by that, “what’s that got to do with it” he said. How do interest rates impact anything besides mortgages and loans?

Of course, after recently passing my R02 exam in Investment Principles & Risk, I am slightly more familiar with the relationship between inflation and interest rates than he is. So, I briefly explained the main reasons why it’s a normal thing for BOE to do this at this point in the economy.

I found out two things from that conversation:

- Just how much I had actually learned while studying for that exam. Gave myself a humble pat on the back.

- Too many people fear inflation and interest rates because they only have a surface level knowledge on them.

No wonder people get the cold sweats when they hear that inflation is rising. The consequences can be incredibly damaging if it’s left untamed. Yes, “untamed” as if we’re talking about a mythical omnipresent creature that lurks in the dark, threatening life as we know it. It is said that people only fear that which they don’t know, so allow me to introduce you to inflation on a deeper level. I can’t promise that you won’t continue to fear it but hopefully you’ll have a better understanding of its impact on the broader economic landscape.

Inflation is only a part of our macroeconomic storyline, and in this article, I’ll attempt to explain the following points:

- What is the economic cycle and what are its stages?

- How does inflation fit into the cycle and why raising the interest rates works in “taming” inflation?

- How does the economic cycle impact different assets such as cash, fixed interest, and equities?

The Economic Cycle

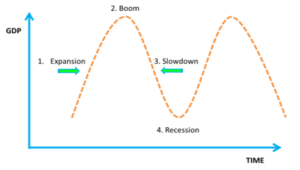

The cycle can be divided into four main phases. Economic activity in each of those phases is measured by the growth in Gross Domestic Product (GDP). GDP is the total monetary value of all goods and services in the UK.

As you can see in the above graph, during the expansion phase GDP rises as the economy experiences growth. In the Boom phase, GDP is growing at its fastest rate. During these two phases, the prices are rising and what happens when prices rise? Inflation.

When GDP growth begins to fall compared to the previous quarter, it is said that the economy is in slowdown. If GDP continues to fall for two consecutive quarters, it is considered that the economy is in recession.

How does the government control inflation?

One of the tools in the government’s arsenal against inflation is adjusting interest rates. The Bank of England uses them to influence inflation and to control the economic cycle. Due to this, there is a general tendency for interest rates and the rate of inflation to have an inverse relationship.

In general, when interest rates are low – the economy grows but so does inflation. This happened in the UK quite recently in 2020, the BOE reduced interest rates due to the Covid-19 pandemic. In turn, this allowed businesses and individuals to borrow more at a reduced rate. It’s not surprising that there is a massive property purchasing boom that’s been happening within the last two years.

As you can imagine, borrowing more money releases cash into the system. The more cash in circulation, the more businesses need to charge for goods/services offered as there is more demand. People believe they have more to spend, so they go out and spend it. Naturally, prices continue to increase with demand until the economy “heats” up and levels can’t be sustained anymore.

To dampen the effects of rising prices (i.e. inflation) BOE will increase interest rates. As the interest rates go up, consumers tend to save because the return on their savings is higher. Businesses and individuals could still borrow money, but the higher interest rates will now eat into their profits, reducing the disposable income that could be spent. This results in the economy slowing down and reduces inflation.

You may be thinking “Hmm, if prices go up when inflation is up, does that mean that the prices will go down if interest rates go up?” The short answer is probably not. As we enter the slowdown phase, the British economy is not growing. At the same time though, prices for food, fuel and clothes are continuing to rise. Here we have the recipe for stagflation.

Stagflation could be considered worse than a recession because it combines the worst outcomes from both worlds – higher prices for services and staple goods plus fewer jobs, lower wages. The last time the UK experienced stagflation was in the 1970s due to the oil crisis. There is a very real chance that we are heading down this path again.

So, how are you meant to protect your finances from inflation? How might your cash, fixed interest account and/or equities perform depending on the phase of the cycle?

It’s not so much the economic cycle that impacts different asset classes, it’s more so the changes in interest rates that have been put in place to control inflation that affect them.

| Expansion & Boom | Slowdown & Recession | |

| Cash | Rising inflation eats into the buying power of cash. The rise in interest rates is a good thing for savers. | To stimulate the economy BOE may reduce interest rates, which makes cash less attractive. |

| Fixed Interest | Vulnerable to interest rate risk. If you’re in a FI contract with a low interest rate and these subsequently rise, you may end up in a disadvantage. | Falling interest rates increase the attractiveness of existing fixed interest investments. If you’re in a FI contract with a high interest rate and these subsequently fall, you may end up with an advantage. |

| Equities | Equities generally benefit as companies’ profits rise. Increases to interest rates will lead to higher borrowing costs and a reduction in profits. Equity prices may fall due to this. | A reduction in interest rates should halt falling equity prices as the costs of borrowing reduce, which will increase profitability. |

Remember that there is risk and reward with every single asset class, even cash gets eaten away over time. Here are a few universal truths when it comes to finances, bills & investing:

- Emergency funds – In a perfect world, people should consider keeping 3 to 6 months’ worth of expenditure in an easy access account.

- Be conscious that your investments can go up as well as down and you may get less than what you originally put in.

- If it sounds too good to be true, it probably is. Scams can be so sophisticated nowadays. Be especially vigilant when it comes to TikTok and other social media “experts”.

I hope that this article has shed at least a little bit of light onto how inflation and interest rates work. Much like everything in life, moderation is key and these two need to be kept in balance. The Bank of England’s Monetary Policy Committee (MPC) meet roughly every 6 weeks to discuss interest rate levels, their next meeting is scheduled for the 17th March 2022. Hopefully after reading this article, you won’t be surprised should they decide to increase rates again.

If you have any questions in relation to this article, or are concerned by the rise in inflation and wish to speak to a financial adviser, please click here to get in touch with our expert team.

By Maggie Tsvetanova, Compliance Assistant.