Earlier this month, Royal London released new research which revealed talking to a financial adviser helps customers feel better about themselves and their money – especially in times of crisis.

In conducting this research Royal London spoke to a UK national representative sample of 4,007 customers. 26% of these had received advice from an Independent Financial Adviser and 74% of these had never received any advice.

What was the outcome of their findings?

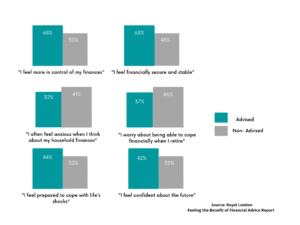

- Clients who receive financial advice feel more confident and financially resilient than those who don’t.

- Clients who have an ongoing relationship with their adviser are almost twice as likely to feel in control of their finances.

- Advised Clients feel they have a much better grasp of financial matters and products.

- Advised Clients who have protection in place feel more prepared for life shocks.

Royal London stated that a real positive is that clients themselves recognise the emotional benefits of advice. Greater confidence, being in control and gaining peace of mind were identified as the top three benefits.

They also found that adviser costs do not diminish the emotional benefits of advice. The customers they surveyed who had received financial advice where twice as likely to agree that the emotional and financial benefits of having an adviser outweigh any costs.

wHERE does this put ifp?

A big part of the research also found that customers feel even more satisfied with their adviser’s services when they have an ongoing relationship in place. At Informed Financial Planning all of our client’s are part of our ongoing advice service which allows us to maintain regular contact with all of our clients.

90% of customers who receive advice and talk to their adviser regularly have even higher levels of satisfaction.

If you feel that you could also benefit from Financial Advice please contact us on 01482 219325 or email [email protected].